As 2024 approaches, the crypto community is bracing itself for an important event in the world of Bitcoin: the Bitcoin halving. This event, scheduled to occur sometime in April or May 2024, marks the reduction in the block reward that Bitcoin miners receive. While this halving happens every four years, it holds significant importance for the network, miners, investors, and the broader cryptocurrency market.

What is a Bitcoin Halving?

At the core of Bitcoin’s design is a limited supply of 21 million coins. The protocol’s supply mechanism includes periodic halving events, which reduce the number of new Bitcoins mined per block by 50%. This event happens every 210,000 blocks (roughly every four years), and it is an essential feature of Bitcoin’s deflationary model.

Currently, Bitcoin miners receive 6.25 BTC for each block mined. After the 2024 halving, this reward will drop to 3.125 BTC. As a result, Bitcoin’s inflation rate will decrease, making the asset scarcer and potentially more valuable, provided demand remains strong.

Why is Halving Important?

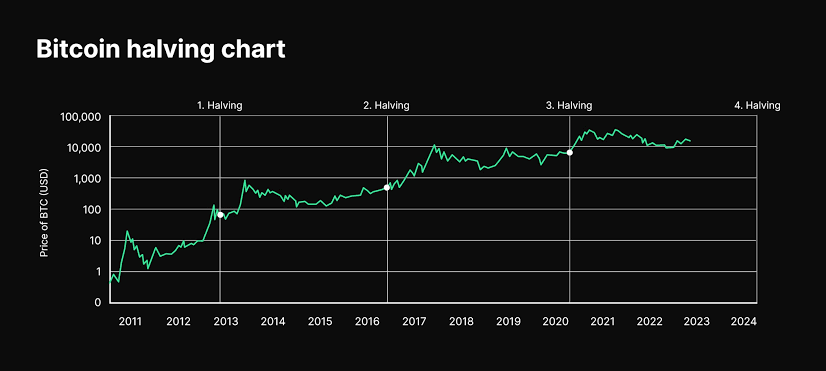

- Supply and Demand Economics: As the halving reduces the rate at which new Bitcoins are created, it effectively slows the growth of the circulating supply. If demand for Bitcoin remains constant or grows, this scarcity could put upward pressure on the price. Many have speculated that previous halvings have contributed to the significant price increases that followed each event, though no one can predict the exact outcome.

- Miner Economics: Miners play a crucial role in securing the Bitcoin network, and halvings affect their revenue. With the reward halving, miners must rely on transaction fees and the value of Bitcoin to make their operations profitable. Smaller, less efficient mining operations may struggle to stay afloat as their reward decreases, which could lead to a shift in the mining landscape.

- Historical Impact on Price: Previous halvings have historically preceded substantial bull runs in Bitcoin’s price. For example, after the 2012 halving, Bitcoin’s price increased from around $12 to over $1,100 within a year. The 2016 halving saw Bitcoin rise from $650 to nearly $20,000 by the end of 2017. However, past performance is not always an indicator of future results, and the market dynamics of 2024 may be different.

What Can We Expect in 2024?

The upcoming halving could have a profound impact on Bitcoin’s price and the broader cryptocurrency market. Many investors are hopeful that the scarcity created by the event will push prices higher, while others caution that external factors such as regulatory developments, macroeconomic trends, or technological advancements might play a more significant role.

With increasing institutional interest in Bitcoin, along with the maturation of the cryptocurrency space, the 2024 halving might lead to greater mainstream adoption. Whether it will trigger another price rally or lead to a period of consolidation remains to be seen.

Conclusion

The 2024 Bitcoin halving is an exciting milestone for the cryptocurrency community. While its effects on the market are unpredictable, it serves as a reminder of Bitcoin’s unique supply mechanism. As always, investors and enthusiasts should approach this event with caution, understanding that while history may provide some guidance, the future remains uncertain.

Stay tuned to our website for more updates and analysis as the halving approaches!